michigan unemployment income tax refund

Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return. Shutterstock Michigan unemployment officials say 12 million residents about.

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Unemployment benefits generally count as taxable income.

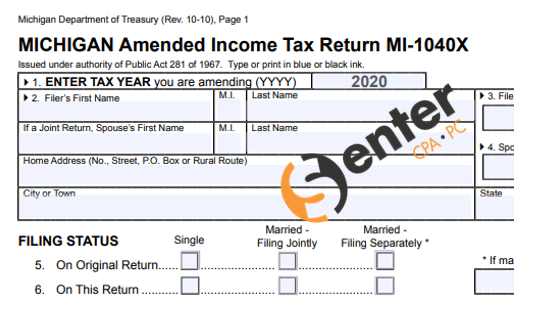

. These taxpayers should file an amended Michigan income tax return to claim that refund. The taxpayer moved into Michigan on July 1 2020. There are two options to access your account information.

You can contact the agency with which you have a debt to determine if your debt was submitted for a tax refund offset. Therefore unemployment compensation is also included in Michigan taxable income. Unemployment compensation is generally included in adjusted gross AGI income under the IRC.

Up to 10200 of unemployment benefits will tax exempt in conformity with IRS treatment. Unemployment income is considered taxable income and must be reported on your tax return. You may check the status of your refund using self-service.

Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back from a. You pay tax in your home state only. The American Rescue Plan Act a relief law Democrats passed in March last year authorized a waiver of federal tax on up to 10200 of.

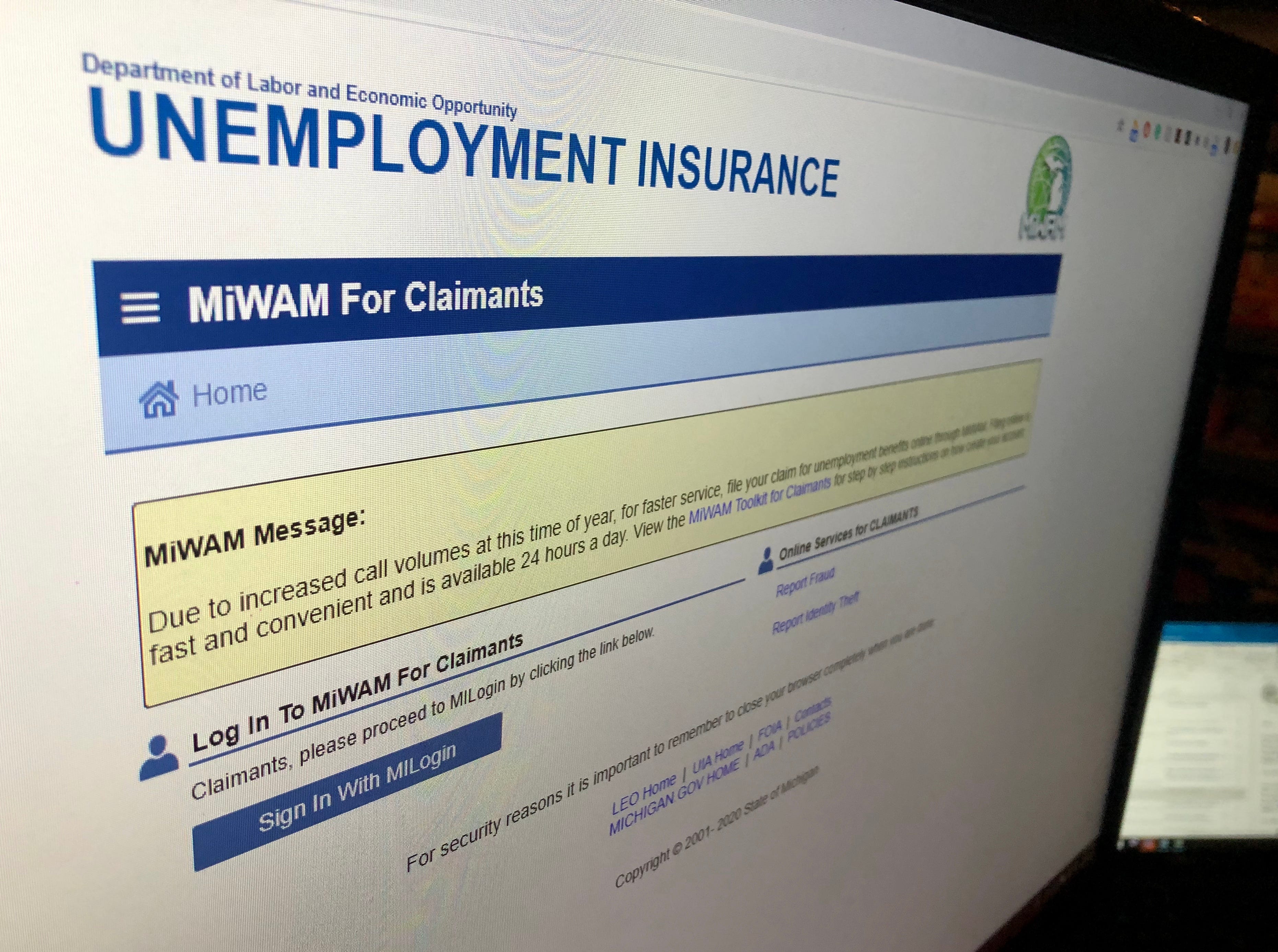

In case you expect a MI tax refund you will need to file or e-File your MI tax return in order to receive your tax refund money. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. Michigan unemployment 2021 tax form coming even as benefit waivers linger.

These taxpayers should file an amended Michigan income tax return to claim that refund. Michigans state income tax is 425. President Bidens recent federal American Rescue Plan Act excludes unemployment.

Tax Treatment of Unemployment Compensation. Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return. 2020 Home Heating Credit MI-1040CR-7 Alternate Credit Computation.

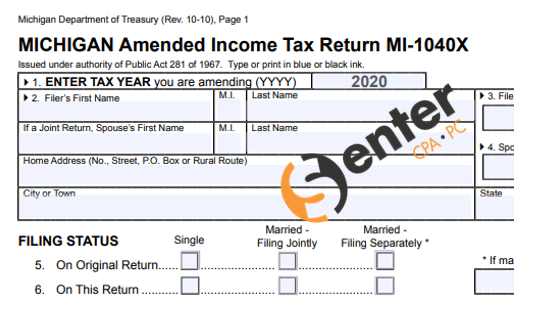

Account Services or Guest Services. CNBC Tax season is here. The State of Michigan has issued a decision on the treatment of unemployment compensation for the 2020 tax year.

On the federal return the taxpayer claimed unemployment income of 12000 and reduced it by 10200 for a net amount in Adjusted Gross Income AGI of 1800. The federal American Rescue Plan Act was signed into law on March 11 2021. A 39 refund Processing Service fee to.

2020 Home Heating Credit MI-1040CR-7 Standard Allowance TABLE B. However the American Rescue Plan Act of 2021 allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020. I f you owe MI income taxes you will either have to submit a MI tax return or extension by the April 18 2022 tax deadline in order to avoid late filing penalties.

Unemployment compensation is treated as taxable income on the federal return and the Michigan income tax return. Tax rates top out at 240 in Detroit hard to incorporate all states changes TurboTax. On a monthly basis the net amount in AGI is 180 180010 months.

Mortgage Foreclosure or Home Repossession and Your Michigan Individual Income Tax Return TABLE A. And e-File your 2021 IRS and state Taxes a IRS priority year and refund. It is included in your taxable income for the tax year.

500 michigan unemployment tax refund 2021 500 750 1250 or. For March April May and June the taxpayer allocates net unemployment income of 720. Please enable JavaScript to continue using this application.

MoreMichigan jobless claimants wont get key tax form until end of February. Effect of the American Rescue Plan Act on the taxation of unemployment compensation. CNBC Unemployment tax refunds may be seized for unpaid debt and taxes May 18 2021.

Many people of course could be stumped when it comes to whether. Than 21 days refund. For state purposes taxable income is defined in MCL 20630 as adjusted gross income as defined in the IRC.

And yes that unemployment compensation is treated as taxable income on the federal return and the Michigan income tax return. In the latest batch of refunds announced in November however the average was 1189. When you create a MILogin account you are only required to answer the verification questions one time for each tax year.

Therefore the federal exclusion of certain unemployment compensation will result in a lower federal AGI which will flow-through to the Michigan return resulting in a lower taxable income. Certain unemployment compensation debts owed to a state generally these are debts for 1 compensation paid due to fraud or 2 contributions owing to a state fund that werent paid. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse.

If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings. State income tax obligations. Dont expect a refund for unemployment benefits Jan.

That means the average refund for one week of unemployment from last spring and summer would be roughly 40. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. While the federal government tweaked this rule in 2020 in response to COVID-19 those who collected unemployment income in 2021 should expect to pay the full taxes on those benefits.

The states unemployment agency is still trying to determine how many claims paid out improperly during the pandemic will have to be recouped putting workers in a tough spot during tax season. If you use Account Services select My Return Status once you have logged in. However you dont pay tax in Michigan on unemployment if you no longer live in Michigan.

Michigan Confirms Unemployment Compensation is Taxable for Tax Year 2020. Unemployment compensation is taxable.

Money Minute Tax Forms Available For Michigan Unemployment Claimants

Money Minute Tax Forms Available For Michigan Unemployment Claimants

Form Mi 1040 2011 Michigan Individual Income Tax Return

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Delayed State Jobless Aid Forms Needed To File Taxes Now Available Online

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

State Pushes Back Release Of Unemployment Aid Tax Forms

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Where S My Refund Michigan H R Block

Unemployment Resources Aft Michigan

Inside Michigan S Faulty Unemployment System That Hit Thousands With Fraud Michigan The Guardian

Michigan Families Need Unemployment Benefits And A Functional System

Michigan Taxpayers Reporting Unemployment Compensation Exclusion Recommended To File Amended Returns Doeren Mayhew Cpas

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Abc10 Com

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/02-01-2021/t_097c9f3558714f239e0634ba3af11887_name_image.jpg)